SOC-1 certification in UGANDA

Get Free Consultation

PopularCert is a trusted leader in SOC 1 Certification in Uganda, helping businesses establish robust internal controls for financial reporting. Our tailored services streamline the SOC 1 attestation process, ensuring your organization meets the highest standards of accountability and compliance. By partnering with PopularCert, you gain expert guidance to enhance stakeholder trust, improve operational transparency, and secure your competitive edge in the market. Whether you’re a service provider or a business handling sensitive financial data, we provide end-to-end support for a successful SOC 1 audit.

SOC 1 attestation in Uganda ensures organizations have effective internal controls over financial reporting, building trust with clients and stakeholders. This certification is crucial for businesses handling sensitive financial data, demonstrating accountability and compliance with regulatory standards. SOC 1 provides assurance to clients about the security and reliability of your processes. Achieving SOC 1 attestation enhances credibility, supports business growth, and strengthens client confidence in Uganda’s competitive marketplace.

Why SOC-1 Certification is important for you and your business in Uganda.

SOC 1 certification is essential for businesses in Uganda as it ensures compliance with international standards and supports efforts to improve financial reporting and operational efficiency. It helps organizations mitigate risks, enhance internal controls, and build stakeholder confidence. Additionally, SOC 1 certification boosts credibility and opens doors to partnerships with global clients. Adopting SOC 1 standards strengthens a company’s competitive edge in the global marketplace by demonstrating reliability, transparency, and a commitment to excellence.

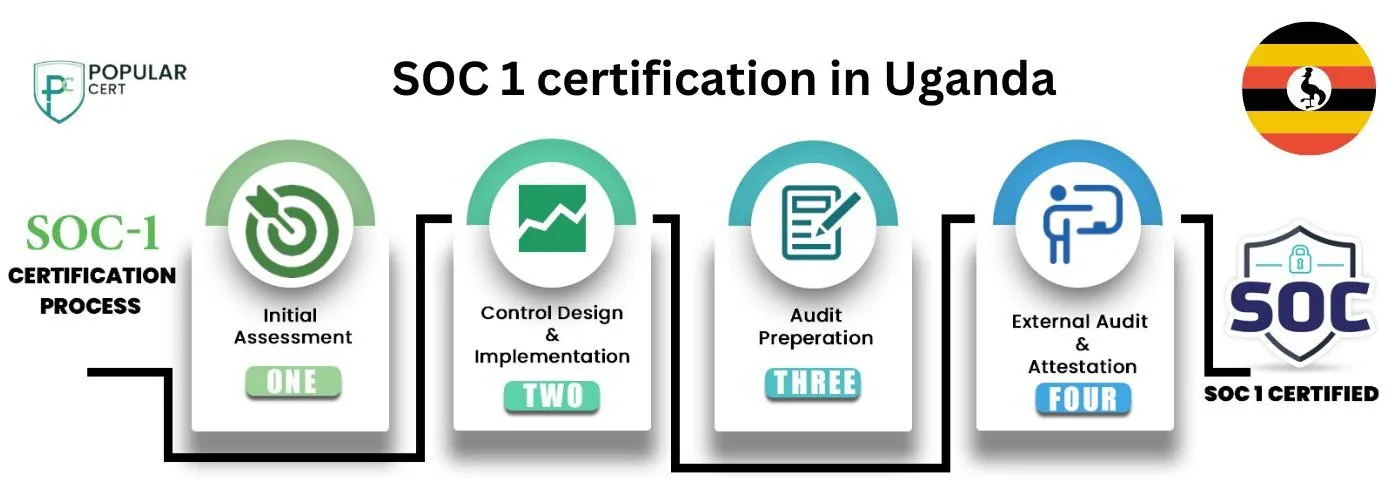

How to Get SOC-1 Certification in Uganda?

Process to Get SOC-1 Certification In Uganda

Evaluate SOC 1 Need

Check if your company requires SOC 1 certification. It’s crucial if your services impact client financial statements – think IT support, payroll, or data hosting.

Pick a Skillful Auditor

Independent auditors, such as certified public accountants (CPAs) or specialized firms, carry out SOC 1 audits. Choose an auditor skilled in SOC 1 audits. Canadian companies need to ensure a thorough, compliant process.

Roll Out a Readiness Assessment

This pre-audit check helps assess current controls and pinpoint gaps. Doing the readiness assessment can fix weaknesses before the formal audit. It helps to increase the chances of clearing the certification process.

Formulate and Initiate Controls

To get SOC 1 certified, businesses need to apply successful controls for financial reporting. These controls need to cover areas like: Data security: Safeguard financial data from unauthorized access or breaches. Change management: Manage modifications to systems or workflows that might influence financial reporting. Transaction handling: Assure financial transactions are accurate and secure.

Experience the SOC 1 Audit

After the controls are ready, your auditor will launch the formal SOC 1 audit. For Type 1 reports, focus will be on the design of controls at a particular time. For Type 2 reports, they will examine both the design and functionality of controls over a specific duration.

Get the SOC 1 Report

Post-audit, your business will get a SOC 1 report detailing findings. If controls are effective, reports affirm your company meets SOC 1 standards. If issues crop up, you’ll have to solve them before getting a clean report.

Benefits of SOC-1 Certification in Uganda

- Finance Services : The finance arena in Uganda has been growing with banking firms, insurance corporations, and investment businesses shaping the economy. These bodies are under strict economic laws, both at home and abroad. SOC 1 attestation shows that finance service suppliers have practical controls over fiscal reporting, crucial for adhering to laws such as Uganda’s Financial Institutions Act or global rules like Sarbanes-Oxley (SOX).

- Telecom Industry : With the growth of Uganda's telecom industry, numerous service suppliers present third-party billing and financial services for their clients. SOC 1 attestation assures clients that telecom firms have appropriate financial controls, reducing the chance of billing errors, fraudulent activities, or fiscal discrepancies.

- Healthcare :The healthcare sector of Uganda is rising and many bodies are engaged in medical billing, coverage claims, and fiscal reporting for healthcare providers. SOC 1 attestation guarantees that healthcare-related organizations possess accurate and safe fiscal processes, helping them fulfill both law-related and client expectations.

- IT and Cloud Service Suppliers : An increasing number of Ugandan firms are utilizing cloud computing and IT services to handle data and fiscal processes. SOC 1 attestation can showcase the reliability of their fiscal controls. This attestation is largely necessary for data centers, software-as-a-service (SaaS) providers, and third-party payment processors.

- Contracted Payroll and HR Services : Ugandan enterprises providing payroll handling, HR services, or related fiscal services can gain from SOC 1 attestation. This certification reassures clients that payroll and employee-related money processes are performed in a controlled and compliant manner.

Types Of ISO Certification In Uganda

- ISO certification in Uganda

- ISO 9001 Certification

- ISO 14001 Certification

- ISO 45001 Certification

- ISO 22000 Certification

- ISO 27001 Certification

- ISO 17025 Certification

- ISO 13485 Certification

- CE Mark Certification

- ISO 20000-1 Certification

- GMP Certification

- HALAL Certification

- SOC-1 Certification

- SOC-2 Certification

Get Free Consultation

Our Clients

Cost of SOC-1 Certification in Uganda

The cost of SOC 1 certification in Uganda depends on the size of the organization, the complexity of its financial reporting and control systems, and its current level of compliance. Typical expenses include gap analysis, training, documentation preparation, audits, and implementation support. PopularCert offers tailored and cost-effective solutions to help businesses in Uganda achieve SOC 1 certification, ensuring compliance with international standards and enhancing operational efficiency.

Why Choose PopularCert For SOC-1 Certification in Uganda?

PopularCert is a globally renowned consulting company specializing in certification, advisory, and auditing services. We are the trusted choice for organizations seeking SOC 1 certification due to our experienced, ethical consultants and proven success record. For SOC 1 certification in Uganda, choose PopularCert, a leader in consultancy, certification, and auditing services. Contact us, and our experts will promptly provide the best solution tailored to your needs.

GET A FREE CONSULTATION NOW

FAQ

What is SOC 1 Attestation?

SOC 1 (Service Organization Control 1) Attestation is a report that evaluates an organization’s internal controls relevant to financial reporting, ensuring compliance with industry standards.

How to get SOC 1 Attestation?

- Step 1: Identify key financial processes and controls.

- Step 2: Conduct a readiness assessment to detect and address gaps.

- Step 3: Implement necessary improvements to align with SOC 1 requirements.

- Step 4: Engage a certified CPA firm to perform the audit.

What are the costs of SOC 1 Attestation?

Costs depend on the complexity of your business processes, scope of the audit, and readiness. Contact PopularCert for a customized quote.

How does PopularCert assist with SOC 1 Attestation?

PopularCert offers comprehensive support, including readiness assessments, control improvements, and coordination with certified CPA firms.