Climate Risk and Financial Stability: The Power of ISO 31000 and ISO 14097 in Modern Banking

Introduction:

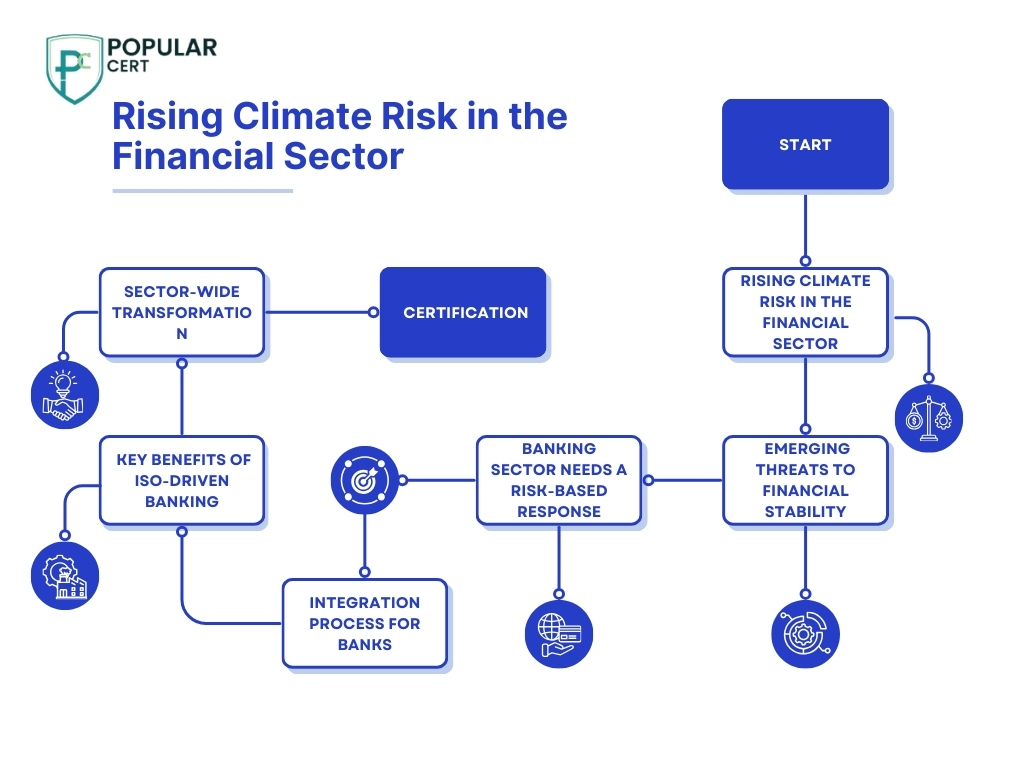

The financial services and banking sector is pivoting, as global market directions shift and the world’s risk perception undergoes a profound change due to increasing climate concerns, the banking sector is simultaneously evolving alongside it. In Jordan, Amman’s metropolis which hosts several of the region’s renowned banks, this change is already in motion. There are two newer standards, ISO 31000 (Risk Management) and ISO 14097 (Climate Finance) which have the potential to greatly assist banks in achieving resilience and enduring adversities and economic hardships. In this blog, we will talk about how these standards modernize and strengthen banking, how Popularcert assists banks in these implementations, and what advantages certified banks hold over non-certified ones.

Why Risk and Climate Standards Matter in Banking

The cornerstone functions of banking – credit, market, and operations – have been traditional risks which have now been blended with even more sophisticated risks such as climate risk, cyber security threats, and social responsibility obligations. Organizations like TCFD and IFRS’s ISSB have persistently been urging banks to assess how banks integrate environmental risks into their strategies and business models – to spell it out, they want to know how banks manage these risks.

Here is what driving the shift:

- The Need for Greater Disclosure on Climate Change by Regulators and Self-Regulatory Organizations.

- The Growing Trend of Investors Intending to Make ESG-related Investments.

- Global Developments such as Cyber Crime or Economic Turbulence.

- Societal Expectations that Invite Ethical Banking Solutions.

ISO 31000 and ISO 14097 offer globally recognized frameworks to these emerging concerns to foster trust, transparency, and resilience.

Understanding All Standards

ISO 31000 – An All-Inclusive General Risk Management Approach

- Goal: Facilitates processes for identifying, assessing, and alleviating potential risks which may be financial, operational, or strategic.

- Core Benefit: Enables comprehensive decision-making across all activities performed by the institution.

- Core Components:

o Integration of leadership and governance

o Risk identification and analysis

o Culture and strategy alignment

o Strategy review and monitoring

ISO 14097 – A Framework for Climate Finance

- Goal: Equip financial institutions to assess the climate risk exposure and opportunity regarding emissions for the investments and loans provided.

- Core Benefit: Ensure compliance to global ESG and sustainability reporting frameworks by the institutions.

- Core Components:

o Climate governance and risk management

o Set pathways for Emission and target achievement

o Provide guidance for emission’s transparency, reporting, and financial impact explanatory.

Types Of Certification

- ISO Certification

- ISO 9001 Certification

- ISO 14001 Certification

- ISO 45001 Certification

- ISO 22000 Certification

- ISO 27001 Certification

- ISO 17025 Certification

- ISO 13485 Certification

- CE Mark Certification

- ISO 20000-1 Certification

- GMP Certification

- Halal Certification

- SOC-1 certification

- SOC-2 certification

Get Free Consultation

Our Clients

ISO 31000 Internal Audit Checklist

ISO-Certified vs Non-Certified Banks: A Clear Competitive Edge

Here is a comparison of ISO-certified vs non-ISO certified banks in Amman:

Feature/Capability | ISO-Certified Banks (e.g., ISO 31000, ISO 14097) | Non-Certified Banks |

Risk Management Framework | Structured, proactive, compliant with best practices | Reactive and often ad hoc |

Climate Risk Assessment | Integrated climate finance models | Minimal or no climate disclosures |

Investor & Regulatory Confidence | High – trusted for governance and transparency | Moderate – limited data-driven insights |

Operational Resilience | Proven continuity and risk-based planning | Vulnerable to disruptions and shocks |

Market Competitiveness | Higher – appeals to ESG investors and global partners | Lower – limited international appeal |

Reputation and Public Trust | Strengthened by transparency and responsibility | Potentially at risk from governance gaps |

Amman Banks Adopting to ISO Certification

A few financial institutions in Amman have adopted ISO frameworks that help in gaining operational maturity as well as international recognition:

Arab Bank

- Among the largest banks in the Middle East.

- Certified for ISO/IEC 27001 for information security.

- Advancing towards ESG and risk-based frameworks.

Jordan Kuwait Bank

- Has made risk governance system investments aligned with ISO 31000.

- Integrating climate finance approaches to increase green financing.

Bank al Etihad

- Known for his innovation and digital transformation.

- Focus on sustainability puts them on course for ISO 14097.

Even though complete certification for ISO 14097 is not available yet, Jordanian banks are aligning themselves to be the region’s leaders, giving them a competitive advantage internationally.

The Rarest ISO Standard in the Financial Sector

ISO 37000- Governance of Organizations

- Why it is rare: This standard place an organization’s strategy, higher-level execution mechanisms, governance systems and subtleties, as well as decision making authority and responsibility (accountability) a notch above than that found in a basic operational framework, which is highly unusual.

- Why it matters in banking: It enables ethical stewardship and board dominion concerning sustainability as well as accountability and trust in stakeholder relations.

- Relevance in Amman: Any person aiming to pose as a governance champion in the Middle Eastern region should think about adopting ISO 37000.

How Popularcert Helps Financial Institutions in Amman

Popularcert is a consulting firm with an exclusive focus on developing tailored consulting packages for ISO 31000 and ISO 14097 and relevant standard implementation by banks in Amman. Possessing expansive expertise in financial regulation, ESG policies, and climate disclosure policies, Popularcert ensures implementation effectiveness and efficiency.

The Strategies of Popularcert Include:

- ISO standards gap measurement.

- Creation of tailored trainings for Senior Executives, Risk Managers and Sustainability Managers.

- Document support, alignment with CBJ, TCFD, and ESG frameworks.

- Internal audit preparation and control setup.

- Monitoring and certificate upkeep along with iterative enhancements each cycle.

Additional Services Include:

- Enhanced risk assessment utilizing ISO/IEC 27001 integrated with ISO 31000.

- Application of ISO 14097 with the UN Sustainable Development Goals.

- Construction of an entire trust-building roadmap for ESG disclosure.

Conclusion

The combination of ISO 31000 and ISO 140973 represents a need, especially now when financial factors are combined with an environmental perspective and foresight. Banks in Amman adopting these standards would be less susceptible to market shocks while gaining the trust of investors and subsequently, access to green financing. With Popularcert, banking businesses in the region now have step-wise support for turning their operations into ethical, resilient enterprises while ensuring business continuity through ISO certification

GET A FREE CONSULTATION NOW

FAQ

What is the importance of implementing ISO 31000 and ISO 14097 for banks in Amman?

To improve trust from investors, risk resilience and climate accountability need to be enhanced.

What role do the Green Standards of the United Nations Framework for International Climate Change help to achieve with the Iso?

They permit the utilization of sustainable finance by aligning banks with ESG measures.

Why is Popularcert particularly best placed for supporting in the Popularcert’s ISO’s?

He or she will receive the help of a refined instructor designed especially to aid financial institutions.He or she will receive the help of a refined instructor designed especially to aid financial institutions.

Does ISO certification aid in establishing a bank’s business continuity plans? Does ISO certification aid in establishing a bank’s business continuity plans?

Indeed, it enables the development of orderly frameworks for mitigating disruptions to operational activities.