ISO 13491: The Key to Safeguarding Kuala Lumpur’s Digital Banking Transactions

Introduction:

Kuala Lumpur has automated banking services, enabling digital transactions which makes daily undertakings easier. Nevertheless, the digitization of financial activities heightens the risk associated with insecure systems and inadequate protection. Cyber threats, fraud, and breaches pose significant risk to sensitive financial information. As such, a standard for cryptographic key management, ISO 13491, is fundamental in the protection of such information. Furthermore, the ignorance and sidelining of this standard in Kuala Lumpur’s financial institutions increases the vulnerability of the sector and erodes operational effectiveness as well as global confidence in the system. In this regard, the current blog seeks to elucidate the relevance of ISO 13491 and cite practicals that can advance the security and competitiveness of Kuala Lumpur’s financial services industry.

A Major Financial Setback for Kuala Lumpur: The Cost of Overlooking ISO 13491

Kuala Lumpur has full ATM services, online banking access, and card payment systems, which has boosted the use of ATMs. Additionally, the region has ease of transport connected with other states. However, lack of understanding of ISO 13491 makes it difficult to protect sensitive financial transaction data. Because of karate systems, urgent action is required for secure management of cryptographic keys. ISO 13491 sets forth rigorous defensive protocols to protect systems from tampering, theft, and cybercrime.

A Big Loss for Kuala Lumpur’s Finance Sector for Being Unaware of ISO 13491

- ISO 13491 ensures secure cryptographic key management, essential for ATMs, card payments, and secure financial transactions.

- Lack of awareness increases risk of cyberattacks, fraud, and data breaches in banking operations.

- Non-compliance leads to reduced trust from global financial partners and limits international collaborations.

- Potential financial penalties and reputational damage due to data protection failures and poor encryption practices.

Without the adoption of the international standard, Kuala Lumpur will grow less appealing to global financial institutions. Secured data is being prioritized by investors and clients and Singapore and Tokyo have already implemented ISO 13491 in their financial sectors. If Kuala Lumpur continues to ignore this standard, it risks falling behind in the race to become a Fintech leader and in economic resilience.

Types Of Certification

- ISO Certification

- ISO 9001 Certification

- ISO 14001 Certification

- ISO 45001 Certification

- ISO 22000 Certification

- ISO 27001 Certification

- ISO 17025 Certification

- ISO 13485 Certification

- CE Mark Certification

- ISO 20000-1 Certification

- GMP Certification

- Halal Certification

- SOC-1 certification

- SOC-2 certification

Get Free Consultation

Our Clients

The Rising Need for Financial Stability in Kuala Lumpur Through ISO 13491 Implementation

As Kuala Lumpur develops into a financial hub in the region, the demand for stable and secured financial systems becomes extremely important. ISO 13491 aids institutions in securely managing cryptographic keys which safeguards sensitive banking transactions from cyber threats. During the current period of rapid expansion of digital finance, the implementation of such standards is a necessity for achieving long term financial stability.

The Growing Need for Stabilising Finance in Kuala Lumpur Through ISO 13491

- ISO 13491 provides standardized cryptographic key management, crucial for ATM networks and secure financial transactions.

- Ensures protection against financial fraud and data breaches, which are rising in Malaysia’s digital economy.

- Builds trust in digital banking infrastructure, encouraging both domestic and foreign investment.

- Supports compliance with international data security regulations, improving global trade and finance opportunities.

Implementing ISO 13491 will help stabilize financial systems as secure environments for transactions are provided, aligning Kuala Lumpur with the global standards of practices put forth by other financial institutions across the globe. This has the ability to increase the confidence of international regulatory bodies and investors, improving Malaysia’s position in the competitive finance market. If this standard continues to be ignored, the economy will most likely face security issues.

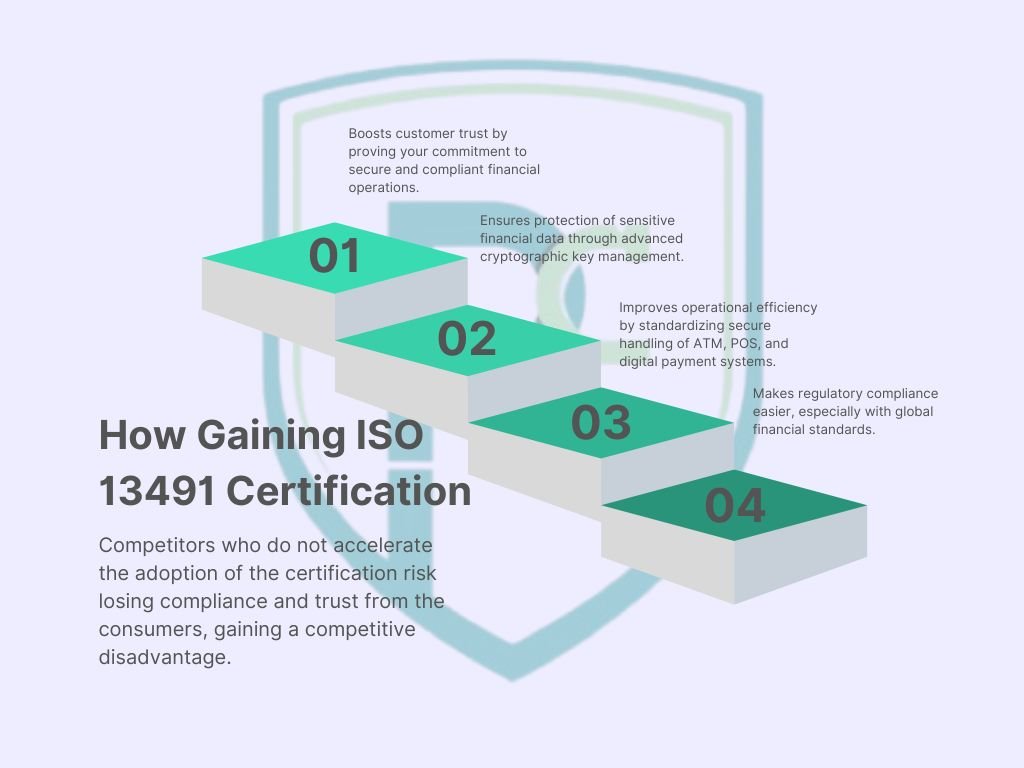

How Gaining ISO 13491 Certification Can Give You a Competitive Edge Over Your Rivals

Acquiring ISO 13491 certification distinguishes your firm within the finance industry given its ever-changing nature since it indicates high levels of security and operational efficiency. Working with an organization that actively protects their information and transactions mitigates risks, which makes clients and partners feel more secure. This trust fosters increased business, enhanced retention, and protects market share while boosting reputation within the finance industry.

Competitors who do not accelerate the adoption of the certification risk losing compliance and trust from the consumers, gaining a competitive disadvantage. Companies that do not have a systematic approach to efficiently manage keys face heightened risk and substantial financial implications as threats to cybersecurity grow. Pursuing ISO 13491 certification early enhances the ability to appeal to investors, clients, and governing bodies while minimizing risk resulting from unanticipated consequences.

Popularcert: Your Trusted Partner in Certification Consultancy

When we look at companies providing professional certification services, Popularcert specific consultancy comes on top. They ensure that clients do not get inconvenienced by providing consulting, training, audits, and also certifications at once. Having mastered multiple client standards like ISO, CE Mark, HACCP, Halal, BIFMA, GMP, RoHS, Popularcert meets the varying client needs by consolidating several certifications to serve the business needs.

Conclusion:

In conclusion, ISO 13491 is no longer just a recommendation but a critical necessity for financial institutions in Kuala Lumpur to maintain their competitive edge and ensure the security of sensitive financial transactions. The growing importance of digital banking and financial technology makes adherence to such standards paramount for preventing cyberattacks, fraud, and data breaches. By embracing ISO 13491, Kuala Lumpur’s financial sector can position itself as a secure, trustworthy, and globally compliant hub, fostering greater investment and enhancing its standing in the international finance community. Failing to implement this standard could result in reputational damage, regulatory penalties, and a loss of business opportunities, potentially hindering the city’s financial growth.

GET A FREE CONSULTATION NOW

FAQ

What is ISO 13491 and why is it important for Kuala Lumpur’s finance sector?

ISO 13491 is an international standard that outlines best practices for cryptographic key management, specifically focusing on securing sensitive financial data during digital transactions. It is crucial for Kuala Lumpur’s finance sector as it helps protect against cyber threats, fraud, and data breaches, ensuring the integrity and security of financial systems like ATMs, card payments, and online banking.

How can implementing ISO 13491 help Kuala Lumpur’s financial institutions stay competitive?

By adopting ISO 13491, financial institutions in Kuala Lumpur can enhance their data security and establish a reputation for operational excellence. Compliance with this standard builds trust among clients, investors, and international financial partners, improving the city’s attractiveness as a global financial hub. It also ensures alignment with international security regulations, supporting seamless cross-border transactions and investment opportunities.

What are the risks of not adopting ISO 13491 for financial institutions in Kuala Lumpur?

Failing to adopt ISO 13491 exposes financial institutions to significant risks, including cyberattacks, data breaches, fraud, and a loss of trust from global partners. Non-compliance can lead to regulatory penalties, reputational damage, and reduced access to international collaborations and investments. As digital finance grows, the lack of robust cryptographic key management may make institutions vulnerable to emerging security threats.