What Is a SOC 1 Report and When Do You Need It? A Complete Guide for Service Providers

Introduction:

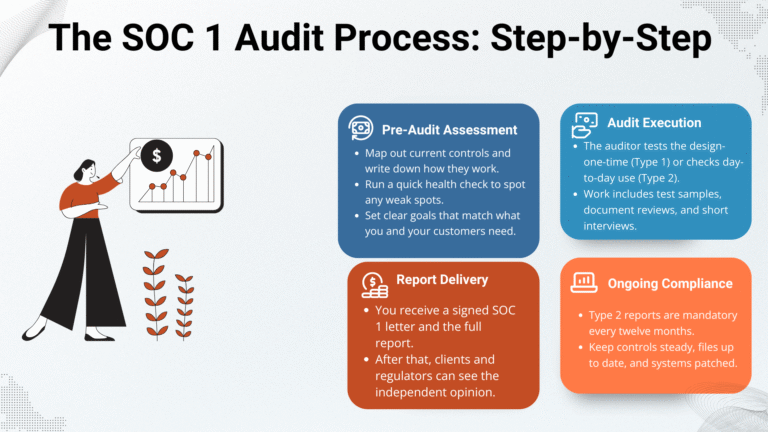

As companies hand off vital tasks such as payroll, bookkeeping, and data processing, making sure those partners run tight internal controls becomes a top concern. That is where the SOC 1 report steps in-a worldwide gauge that shows whether financial controls are up to scratch. But what is it, exactly, and when should your firm care about getting one?

In this post we will walk through what a SOC 1 report covers, who relies on it, and why it can seal or sabotage client trust. We Will also explain how Popularcert guides businesses smoothly from start to finish on the SOC 1 journey.

What Is a SOC 1 Report?

A SOC 1 report, short for System and Organization Controls 1, is an outside auditors snapshot of how well a service supplier safeguards financial reporting controls. Grounded in the AICPA SSAE 18 standard, it is aimed at firms that process sensitive monetary transactions for customers.

If your operation touches anything that might sway a clients balance sheet, you might find yourself needing a SOC 1 examination.

Key Factors to Consider

The service group wrote an assertion about its system and safeguards; an independent CPAs opinion on whether those controls are well designed and working as promised; and a line-by-line record of control targets plus the auditors testing results.

Types of SOC 1 Reports: Type 1 vs Type 2

SOC 1 reports come in two flavors, and the right one hinges on how deep and how steady your internal controls really are:

1. SOC 1 Type 1

- Think of it as a snapshot taken on a single day.

- It checks whether your controls are built the right way, on paper.

- Best for brand-new audits or teams still figuring out the compliance game.

2. SOC 1 Type 2

- Now you’re looking at a stretch of months-usually between six and twelve.

- This time the audit probes whether those controls keep doing their job day after day.

- Larger clients and seasoned firms usually ask for Type 2 to see lasting results.

- Companies often kick off with Type 1 and slide into Type 2 as their processes level up.

Types Of Certification

- ISO Certification

- ISO 9001 Certification

- ISO 14001 Certification

- ISO 45001 Certification

- ISO 22000 Certification

- ISO 27001 Certification

- ISO 17025 Certification

- ISO 13485 Certification

- ISO 20000-1 Certification

- ISO 22301 Certification

- ISO 50001 Certification

- ISO 37001 Certification

- IATF 16949 Certification

- ISO 29001 Certification

- ISO 31000 Certification

- ISO 20121 Certification

- ISO 10002 Certification

- ISO 41001 Certification

Get Free Consultation

Our Clients

When Do You Need a SOC 1 Report?

You probably want a SOC 1 if your business:

- Moves money or handles sensitive financial data for other firms.

- Runs outsourced payroll, accounting, investment reporting, or claims work.

- Clients demand the report during procurement talks or contract sign-offs.

- Plans to grow fast or break into enterprise markets where rules are strict.

- Wants to earn trust and cut the hassle during audits or due-diligence checks.

- Fields That Commonly Rely on SOC 1

- Payroll service providers.

- Accounting and bookkeeping firms.

- Cloud-based ERP or billing platforms.

- Third-party administrators (TPAs).

- SaaS platforms that handle financial reporting.

What’s Included in a SOC 1 Report?

- A SOC 1 report, and it's more common Type 2 version, is a formal file prepared by an outside auditor. The key sections it usually contains are as follows:

- Management Assertion A brief note where the service provider asserts its own control system works as claimed.

- Auditor's Opinion An independent judgements view on whether those controls are presented fairly and doing their job.

- System Description A plain-language rundown of the people, technology, services, and overall control setting in use.

- Control Objectives and Controls A paired list spelling out what the controls aim to achieve and how each one carries that aim out.

- Testing Results for Type 2 Concrete test notes and samples showing each control performed consistently over the full reporting window.

What’s Included in a SOC 1 Report?

Investing in a SOC 1 report carries several big-picture benefits:

- Earn Client Trust Show customers you are open, mature, and serious about keeping their data safe.

- Management Assertion A brief note where the service provider asserts its own control system works as claimed.

- Reduce Audit Headaches One third-party stamp of approval can spare you from endless on-site client reviews.

- Differentiate from Competitors A SOC 1 badge signals professionalism and readiness for the next growth step.

- Identify and Fix Gaps The walkthrough and testing often uncover control blind spots you can patch fast.

Benefits of Getting a SOC 1 Report

SOC 1 vs. ISO 27001: Which One Should You Get?

- SOC 1 zeroes in on financial controls; ISO 27001 looks after the wider world of information security. So, which one do you need?

- You pull a SOC 1 when a client asks for it.

- You pursue ISO 27001 to prove and improve your own security muscle.

- Many firms go for both, giving customers peace of mind about money and data at the same time.

Why Choose Popularcert for Your SOC 1 Report?

At Popularcert, we guide service companies of every size through the SOC 1 audit journey. Our certified auditors and compliance pros pair broad industry know-how with a clear, efficient approach.

With Popularcert, you get:

- AICPA-compliant SOC audit services

- Industry-specific pre-audit consulting

- Expert guidance from planning to certification

- Affordable, fixed-cost pricing with no surprises

- Global experience across fintech, SaaS, healthcare, and logistics

Whether you’re securing SOC 1 Type 1 for the first time or upgrading to Type 2, we deliver results on schedule and within budget.

Conclusion: Secure Your Growth with SOC 1

More than a box tick, a fresh SOC 1 becomes your edge over rivals who handle financial data. It comforts clients, elevates your reputation, and unlocks larger, enterprise contracts.

Want to tighten compliance and win trust?

Let Popularcert steer you through the SOC 1 process-easily, on budget, and pro.

GET A FREE CONSULTATION NOW

FAQs

How long does it take to get a SOC 1 report?

Designated Type 1 reviews usually wrap up in three to six weeks. So-called Type 2 reports, however, need about three to six months because they observe controls over time.

Who performs SOC 1 audits?

Only licensed CPA firms-such as Popularcert-can issue an official SOC 1 report.

Can a small business get a SOC 1 report?

Absolutely. Countless start-ups pursue a Type 1 to calm customers and grow fast.

Is SOC 1 the same as SSAE 18?

Yes, SSAE 18 is the guiding standard on which SOC 1 examinations are built.

How often do I need a SOC 1 report?

Once a year, especially if contracts auto-renew or clients check compliance on schedule.