PCI DSS Certification

Get Free Consultation

A PCI DSS certification is a confirmation that an organization has met all the requirements of the Payment Card Industry Data Security Standard and cardholder data is securely protected during its storage, processing, or transmission. This was set up by the PCI Security Standards Council which governs businesses that process payment cards such as credit and debit cards. Obtaining a certificate is proof that an organization values customer data and strengthens their relationship with customers.

What is PCI DSS Certification?

PCI DSS is an acronym for Payment Card Industry Data Security Standard. It is a worldwide accepted benchmark formulated to secure cardholder information during the credit or debit transaction process. PCI DSS Certification ensures that any organization involved in payment card data handling, either through storage, processing or transmission, adheres to stringent protective measures regarding fraud and theft of sensitive data.

Visa, Mastercard, American Express, Discover and JCB are some of the main credit issuing companies that developed these standards. These standards apply to every business, be it an online shop or retail store, financial institution or a service provider. Any organization that uses payment cards in their activities needs to comply with PCI DSS.

The certification involves 12 primary requirements like building a secured network and system perimeter, enforcing elements like robust access control mechanisms with unique user IDs for entities needing dial-up connections , safeguarding hosted data: firewalls -based breach suppression systems , routine monitoring and testing of pertinent systems among others.. These plus other factors inhibit cyber threats and attacks which lead to identity theft along with occurrence of career breaks.

How to Get PCI DSS Certification?

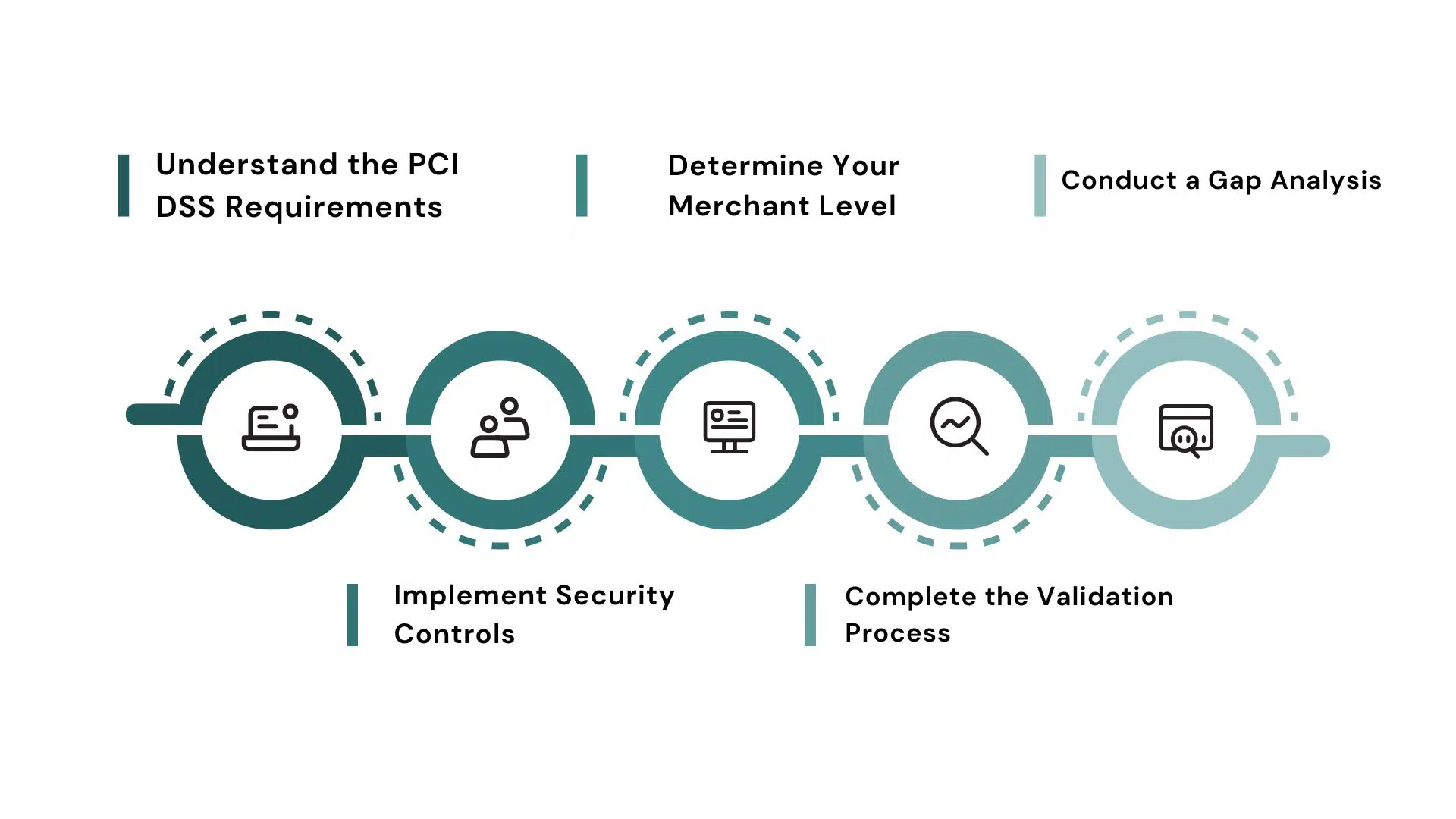

How to Get PCI DSS Certification: Step-by-Step Process

Step 1: Understand the PCI DSS Requirements

Start by reviewing the 12 core requirements of PCI DSS. Understand which apply to your business based on how you handle cardholder data.

Step 2: Determine Your Merchant Level

Your certification process depends on your business size and transaction volume. PCI has 4 merchant levels—identify yours to know which validation method is required.

Step 3: Conduct a Gap Analysis

Assess your current systems and processes. Identify what’s missing or non-compliant so you can take corrective actions to meet PCI DSS standards.

Step 4: Implement Security Controls

Fix the gaps by updating your security measures—firewalls, data encryption, access control, anti-virus protection, and more.

Step 5: Complete the Validation Process

Hire a Qualified Security Assessor (QSA) or perform a self-assessment (SAQ) based on your level. Submit the required documents (ROC or SAQ) and Attestation of Compliance (AOC).

Why is PCI DSS Certification Important?

Types Of Certification

- ISO Certification

- ISO 9001 Certification

- ISO 14001 Certification

- ISO 45001 Certification

- ISO 22000 Certification

- ISO 27001 Certification

- ISO 17025 Certification

- ISO 13485 Certification

- ISO 20000-1 Certification

- ISO 22301 Certification

- ISO 50001 Certification

- ISO 37001 Certification

- IATF 16949 Certification

- ISO 29001 Certification

- ISO 31000 Certification

- ISO 20121 Certification

- ISO 10002 Certification

- ISO 41001 Certification

- CE Mark Certification

- Halal Certification

- BIFMA Certification

- RoHS Certification

- HACCP Certification

- GMP Certification

- Organic Certification

- AS9100 Certification

- TL 9000 certification

- SA 8000 certification

- SoC Certification

- GDPR Certification

- HIPAA certification

- Sedex Certification

- PMP Certification

Get Free Consultation

Our Clients

PCI DSS Certification is crucial for protecting sensitive payment information from theft, fraud, and various cyber threats. Businesses today must practice due diligence when handling customer data. With PCI DSS, businesses adopting stringent security frameworks dry up opportunities for breaches into private information.

Here’s why it matters:

- Protects Customer Data: Safeguards credit and debit cards from unauthorized access or nefarious use.

- Builds Customer Trust: Customers gain confidence purchasing goods and services since they know their data is looked after.

- Ensures Legal and Industry Compliance: Businesses that do not comply may incur fines, penalties or even lose the right to process payments.

- Reduces Financial Risk: Helps avoid significant losses stemming from data breaches, fraud, and damage to social reputation.

- Improves Security Practices: Guides your company towards adoption of proper IT and data protection measures pertaining to the industry policies.

- Every business wishing to earn customers’ trust while ensuring success should have PCI DSS Certification as a priority.

Why Was PCI DSS Created?

To mitigate the chances of credit card fraud and secure data breach, PCI DSS (Payment Card Industry Data Security Standard) was established. In 2004 it was developed by the major credit companies Visa, Mastercard, American Express, Discover and JCB which formed the PCI Security Standards Council (PCI SSC).

Here’s why PCI DSS was created:

- Protecting critical information related to sensitive payment cards from theft, misuse and unauthorized access.

- Formulate a universal security benchmark for all enterprises that deal with card processing.

- Combat the increasing rate of breaches in data and cyber assaults focusing on sensitive financial data.

- Boost confidence within customers alongside businesses and payment processors.

The lack of a uniform strategy for ensuring payment security prior to PCI DSS is evident. Today organizations are able to secure vital information, sidestep potential penalties while fostering a safer payment environment for all participants.

Benefits of PCI DSS Certification

For organizations that process payment cards, obtaining a PCI DSS certification provides numerous strategic advantages. Storing sensitive information about your customers is in no way an easy thing—becoming certified means smoother operation and optimal customer safety all around.

Here are the key benefits:

- Enhanced Data Security: Keeps insistence cardholder data safe from hacking or unauthorized access.

- Regulatory Compliance: Meets certain standards necessary for law policies thus averting fines or legal distraction.

- Builds Customer Trust: Demonstrates to consumers their payment details are protected improving brand image.

- Stronger Business Reputation: Improves the trustworthiness and responsibility perception of your business.

- Reduced Financial Loss Risk: Reduces chances of filling costly penalties due breached data or identity theft.

- Improved Operational Efficiency: Leads to improvement in practices involving internal security concerning data precision as well as elimination of needless redundancy concerning data preservation.

Which Industries Need PCI DSS Certification

Online retailers that accept card payments through websites or mobile apps.

Brick-and-mortar stores using card swiping machines or digital payment methods.

SaaS platforms, hosting providers, and payment gateway companies.

Hospitals, clinics, and medical billing companies that accept card payments.

Hotels, airlines, and booking platforms where customers pay by card.

Courier and freight services with online payment systems.

Credit unions, loan agencies, and financial service providers.

Universities and training centers offering online or card-based tuition payment options.

Mobile and broadband companies accepting online payments or auto-billing.

Cost of PCI DSS Certification

Your company’s size, the intricacy of your IT setup, and the certification level needed influence the cost of getting PCI DSS certified. For smaller businesses, operating Z with a Self-Assessment Questionnaire (SAQ) is cost effective since it mainly focuses on internal audits and minimal tools and training. An audit using a Qualified Security Assessor (QSA) can be costly for larger businesses due to additional fees associated with gap analysis, remediation, documentation, and third-party consultants. Expenditures related to vulnerability scanning, penetration tests, system upgrades also come at an additional cost. Costs can vary widely from a few thousand to tens of thousands which assists in avoiding regulatory fines and enhancing customer trust. Compliance aids in data security incurred preventing breaches while avoiding regulatory fines. Your business will showcase receiving compliance tells clients that it rigorously upholds data policy especially in today’s payment-dominated economy.

Why Choose PopularCert for PCI DSS Certification?

With PopularCert, you can confidently secure your PCI DSS Certification with ease using our expert guidance. We help streamline securing payment card data for a business case and protection of the firm’s reputation as well as the customers sensitive information. Therefore, we provide customized end-to-end support based on your company’s specific requirements.

We help guide you through all relevant requirements in simple terms, performing system evaluations and assisting from gap identification to implementation of the necessary security measures. Treatment is provided to every client whether it is an e-commerce startup or an established multinational enterprise which ensures that every business no matter the size receives assistance through the certification process.

Being fully prepared for the certification includes risk assessments, policy creation, staff workshops and audit participation. Ensure you remain compliant submit after-certification change requests without worry after initial audits are performed. PopularCert helps maintain relevance to changes made to standards resulting in active unscheduled audits.

GET A FREE CONSULTATION NOW

FAQs

PCI DSS Certification - What is It?

PCI DSS Certification confirms that your business protects globally sensitive information, such as credit and debit card data, within the transactions you conduct.

Who Requires PCI DSS Certification?

Retailers, e-commerce sites and service providers who store, process or transmit payment card data are required to hold PCI DSS certifications.

Is Having a PCI DSS Certificate Compulsory?

Absolutely not! If your business processes card payments, then your organization will be mandated by primary card companies to comply with standards set by PCI DSS.

What is the Duration of Obtaining A PCI Diss Certification?

It’s all relative to your businesses scale and preparedness. Small companies using Self Assessment tools might finish in weeks while large enterprises can take months.

How Regularly Should Enterprises Validate Their PCI Certificates?

An enterprise must undergo validation checks at least once a year for compliance and maintain regular comprehensive security audits over the course of the year for retention.